freemexy's blog

Despite this development, S&P 500 and Nasdaq indices closed 0.94 and 2.13 percent lower, respectively, while the Dow Jones narrowly rose a meager 0.04 percent. The benchmark S&P 500 index retreated shortly after it retested a critical inflection point at 3226.00. After it failure to puncture resistance, it quickly retreated as losses were accelerated after California Governor Gavin Newsome ordered a shutdown of all bars and indoor dining.

Crude oil fell along with a myriad of other soft commodities. The New Zealand Dollar was the session‘s biggest FX loser right next to the British Pound. The Euro was the session’s champion and rose from what appears to be optimism about the friction-less implementation of a EUR750b aid package. EU leaders will be digitally convening to discuss it later in the week.

Tuesdays Asia-Pacific Trading Session

A relatively sparse data docket places the focus for traders on macro-fundamental themes like the coronavirus and Asian-based geopolitical risks. Beijing and Washington have each sanctioned lawmakers from each respective country in response to tension over the formers passage of a sweeping national security bill in Hong Kong. Renewed US-China trade tensions also dampened risk appetite.

Combined with a pessimistic ending to Wall Street trade, Asia-Pacific stock markets may be in for a rough start. Commodity-linked currencies like the Australian and New Zealand Dollars along with emerging market FX are at risk while a premium may be put on the anti-risk Japanese Yen and haven-linked US Dollar. Brent may fall and could drag petroleum-linked currencies like the Canadian Dollar and Norwegian Krone with it.

Copper Price Outlook

Copper prices may soon retreat to the uptrend that carried it over 45 percent after bottoming out in mid-March. While the common metal did break above multi-month resistance at 2.8745, the character of the last wick especially within the context of breaking above a key barrier is alarming. The long wick and short-bodied nature of the candle suggests there was a desire to climb higher but that confidence was ultimately lacking.

In fact, the candlestick the commodity left behind on Monday closely resembles a Shooting Star. This is typically a sign of indecision which can at times precede a turn lower after an uptrend.

Copper price chart created using TradingView

A broader pullback may then ensue and push copper prices below recently-broken resistance-turned-support and towards the March uptrend. Due to coppers wide application in a number of cycle-sensitive industries like construction and manufacturing, it is frequently seen as a barometer for the growth outlook. Consequently, a retreat could speak to an even more severe underlying weakness in demand.

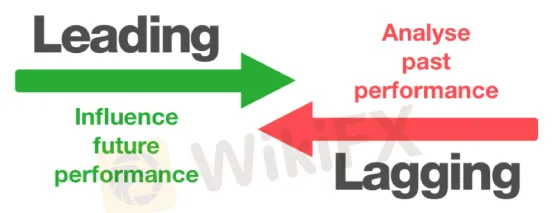

Knowing the leading indicators and lagging indicators to understand the economic trend in second

A

lagging indicator gives a signal after the trend has started and

basically informs you “Hey buddy, pay attention, the trend has started

and you‘re missing the boat.” Lagging indicators work well when prices

move in relatively long trends. They don’t warn you of any upcoming

changes in prices though, they simply tell you what prices are doing

(rising or falling) so that you can trade accordingly. You‘re probably

thinking, “Ooooh, I’m going to get rich with leading indicators!” since

you would be able to profit from a new trend right at the start.You

would “catch” the entire trend every single time IF the leading

indicator was correct every single time. But it won‘t be. When you use

leading indicators, you will experience a lot of fakeouts. Leading

indicators are notorious for giving bogus signals which could “mislead”

you. Get it? Leading indicators that “mislead” you? Haha. Man, we’re so

funny we even crack ourselves up. The other option is to use lagging

indicators, which aren‘t as prone to bogus signals. Lagging indicators

only give signals after the price change is clearly forming a trend. The

downside is that you’d be a little late in entering a position.To get

more news about WikiFX, you can visit wikifx news official website.

Often the biggest gains of a trend occur in the first few bars, so by

using a lagging indicator you could potentially miss out on much of the

profit. And that sucks.

It‘s kinda like wearing bell-bottoms in the 1980s and thinking you’re so cool and hip with fashion…

It‘s kinda like discovering Facebook for the first time when all your

friends are already on TikTok… It’s kinda like getting excited buying a

new flip phone that now takes photos when the iPhone 11 Pro came out…

Lagging indicators have you buy and sell late. But in exchange for

missing any early opportunities, they greatly reduce your risk by

keeping you on the right side of the market. For the purpose of this

lesson, lets broadly categorize all of our technical indicators into one

of two categories:

00001. Leading indicators or oscillators

00002. Lagging or trend-following indicators

While the two can be supportive of each other, they‘re more likely to

conflict with each other. Lagging indicators don’t work well in

sideways markets. Do you know what does though? Leading indicators! Yup,

leading indicators perform best in sideways, “ranging” markets. The

general approach is that you should use lagging indicators during

trending markets and leading indicators during sideways markets. Were

not saying that one or the other should be used exclusively, but you

must understand the potential pitfalls of each.

GBP/USD Upside Clouded! How To Trade Today’s Data?

GBP/USD has

lost its chance to confirm a further increase in the short term,

yesterdays false breakout has signaled that the Pound could lose control

again versus the USD. The dollar is struggling to strike back, the USDX

has registered another false breakdown below the 96.43 static support,

but a rebound is far from being confirmed.To get more news about WikiFX, you can visit wikifx news official website.

GBP/USD has changed little today, maybe the traders are waiting for

the UKs data to bring life on this pair. The GDP is expected to increase

by 5.5% after the 20.4% drop in the former reading period.

Industrial Production could increase by 6.2% in May, versus a 20.3%

decrease in April, the Manufacturing Production is expected to come back

in the positive territory as well, the economic indicator could

register a 7.5% growth. The Construction Output, Goods Trade Balance,

and the Index of Services will be released as well, better than expected

figures could boost the Pound, while some poor data could push GBP/USD

down in the short term.

On the other hand, the USD needs strong

support to be able to give birth to another leg higher versus its

rivals. The US is to release the CPI and the Core CPI later today, only

some positive numbers could save the dollar from the downside.

GBP/USD is traded at 1.2553 level after the failure to close and

stabilize above the 1.2647 and above the upper median line (uml) of the

minor descending pitchfork. Ive said yesterday that the pair could drop

again in the short term if it will register only a false breakout above

the 1.2647 static resistance.

Yesterdays candle, bearish candle,

has invalidated the breakout, so GBP/USD is under some pressure in the

short term as long as it stays below the upper median line (uml). Still,

the bias is bullish as long as the pair is traded above the 50%

retracement level, above the PP (1.2488) level, and most importantly

above the 50% Fibonacci line (ascending dotted line) of the major black

ascending pitchfork.

A further upside movement will be signaled by

a valid breakout from the minor descending pitchforks body, above the

upper median line (uml), a potential valid breakout above the 1.2647

will bring a long opportunity with the target at the median line (ML) of

the major ascending pitchfork.

On the other hand, a reversal, a

larger drop could be confirmed only by a valid breakdown below the 50%

Fibonacci line, if the rate will escape from the up-channel between the

ML and the 50% line.

GBP/USD has developed a double top pattern on the H4 chart, the new

lower low could send the rate down towards the PP (1.2487) level. A

significant drop, sharp decrease, could be activated by an upper median

line (uml) retest, or by another false breakout above this dynamic

resistance.

If you want to go long, you should wait for a valid

breakout above the 1.2647 level or for another bullish signal that will

develop when the current drop will be ended. The critical support stands

at the 50% Fibonacci line of the major ascending pitchfork.

The

pair will be driven by the UK and the US figures today, so you should

keep an eye on the economic calendar. Some great US inflation data will

boost the USD, which it could edge higher versus its rivals.

Foreign exchange markets were somewhat of a mixed bag with the Canadian, New Zealand and Hong Kong Dollar as the session‘s biggest losers. The US Dollar, Japanese Yen and Swiss Franc were mixed while the Euro was mostly in the green. The latter’s strength appears to be in anticipation of hopeful news ahead of the ECB rate decision and key EU summit later this week.

Read more about how Euro traders are betting on the smooth passage of a EUR750b aid package here.

Risk appetite was buoyed after investment bank giant JPMorgan reported record-breaking trading revenue despite worst recession since 1930‘s. This put the haven-linked US Dollar on the defensive and further amplified EUR/USD’s gains. The spread of credit default swaps on sub-investment grade corporate debt slightly narrowed, further underscoring what appeared to be a buoyant session.

After markets closed, US President Donald Trump gave a press briefing on Chinese-related policies. He said the US is ending its preferential treatment for Hong Kong and will no longer export sensitive technologies. He added that if countries want to do business with the US, they cannot work with the Asian tech giant Huawei. Other comments included holding China accountable for the virus and “unleashing” it upon the world.

Wednesdays Asia-Pacific Trading Session

Market sentiment appears to be aggressively risk-on despite the Presidents comments and the possibility of retaliation by Beijing. Crude oil and a slew of other growth-oriented assets like copper, AUD, NZD and emerging-market FX may initially rally at the expense of the US Dollar and Japanese Yen.

JPY will later be thrown into the spotlight ahead of the Bank of Japan rate decision. Markets are not anticipating for officials to change the benchmark interest rate at -0.1%. However, gloomy commentary in the central banks Quarterly Outlook Report could put a premium on the Yen and a discount on risk-oriented assets like AUD and NZD.

NZD/JPY Analysis

NZD/JPY is trading on the cusp of a narrow but critical inflection range between 69.897 and 70.000 that has been in play since November 2019. If the pair bounces, its gains may be capped at 71.249 where the pair just back in late May had flirted with extending its over 11-percent rally that same month. This could subsequently lead to a congestive interim and reinforce underlying uncertainty in NZD/JPYs trajectory.

China Trade Data & US CPI| KOL Analysis•Fanny Arianti Arief

The

euro rose sharply against the dollar yesterday failed important events

in the euro area this week. The euro will discuss the volatility that

will be announced at this week's ECB Thursday and the European Union

meeting (EU Summit) on Friday. The ECB is expected to keep interest

rates, but the market will look at the decision of ECB President

Christine Lagarde, who can provide guidance on policy direction.

Meanwhile, the ECB meeting will be overshadowed by the European Union

(EU) summit on Friday. A compilation of bloc leaders will debate the

recovery plan for the corona virus, which requires support from 27 EU

member states, making negotiations difficult. Ahead of Friday's meeting,

Germany and Italy have supported plans to recover the corona virus

funds asking for € 750 billion. EUR / USD strengthened 0.69% to

1.1369.To get more news about WikiFX, you can visit wikifx news official website.

The dollar lost back yesterday as market protection was awaiting

corporate reports and retail sales data this week, which will gauge

optimism for the US economic outlook. The Dow Jones index rose yesterday

after getting PepsiCo Inc. released better than expected. While major

US banks will report earnings on Tuesday. The dollar index declined 0.3%

to 96.53.

The price of gold held above $ 1800 for profit after an increase in

the number of new corona viruses in the world approved safe-haven

demand. The soaring number of Covid-19 cases in the US has raised doubts

over the economic opening of the lockdown, as well as the resumption of

schools in the fall. In California, Governor Gavin Newsom shut down all

activity in the room, including restaurants, bars and screenings after

the death toll of 7 corona viruses escaped.

Oil prices disappeared yesterday at a meeting of global oil producers

this week amid data showing rising reserves at the US storage center in

Cushing, Oklahoma. Global oil producers, also known as OPEC +, asked to

meet via the web to discuss production. Saudi Arabia, which is the

leader of OPEC, de facto, has pushed its members, reducing production to

drive prices, which in April went down below $ 0 to around $ 40 a

barrel at the moment. Meanwhile, data showed a surge in reserves in the

center of Cushing, Oklahoma. Genscape, Cushing's main indicator as a

market reference, reported 1.2 million barrels at the hub during the

week ending July 10. While Seevol.com, a source reporting at Cushing,

reported an increase of 1.75 million barrels at the hub.

Asian

stocks declined today amid renewed US-China opposition to the economy

from the replacement of coronavirus cases. Shares in Tokyo, Sydney and

Seoul were monitored falling. While the US S&P 500 Futures Index

gained after the index reached its highest level since panic sales

occurred in March.

Selecting a school for your child is one of the most important

decisions that you can make as a family. Wellington College has gained a

strong reputation around the world as an educational leader, providing a

progressive and exciting academic programme that is supported by strong

traditions developed throughout its 161-year history. This continues at

Wellington College Bilingual Tianjin Nursery, as an Tinajin Bilingual Kindergarten

, where pupils are supported by world-class teachers, state-of-the-art

facilities and an environment that promotes a highly individualized

education. At Wellington College Bilingual Tianjin Nursery, we

emphasize the holistic development of each child by knowing their

strengths and supporting their individual needs. This understanding

informs our experienced staff on how to create environments which

nurture a child’s inherently inquisitive minds and sustain their

engagement in a secure setting, and that means we provide a wide range

of both academic and extra-curricular activities.

In addition to this, Wellington College Bilingual Tianjin Nursery offers a wide range of community activities throughout the year, where parents have an opportunity to engage with the school and help make the environment more inclusive and caring for the children.

Below are the most frequently asked questions we receive.

Q1: When can we apply for the 2020-2021 academic year?

The 2020-2021 academic year is already open for application, and the first day of school would be August 26, 2020. We would suggest early application as we do have limited seats in some year levels.

Q2: What are your admissions standards?

Tinajin bilingual kindergarten-Wellington College Bilingual Tianjin Nursery can accept applications for children of the right age of both Chinese and expatriate families who would need to undertake school’s placement assessment. We would recommend a personalised appraisal of your status by contacting our admissions team. The team will help evaluate your status and will be able to answer any question you may have about the enrolment process.

Q3: How school placement assessment looks like?

Prospective parents and pupils will be expected to meet the class teacher for an interview, including an in-class assessment, to ascertain the level of language and motor skills. Language proficiency at this stage is deemed less important than the ability to mix socially with the peer group and to respond positively to the teacher. The assessment informs the Admissions Committee as to whether your child is ready to access the Wellington College curriculum.

Q4: How can we book a campus tour?

Tinajin bilingual kindergarten-Wellington College Bilingual Tianjin Nursery reopened on June 2nd 2020. We are able to offer a limited number of onsite tours on one to one basis by appointment and approval as per the current regulations. Please contact our hotline numbers below to book an appointment with our admissions officers.

Q5: Do you offer a bus service? What are the bus routes?

Yes. For the 2020-2021 academic year, Wellington offers 13 school bus routes with over 60 pickup points across the majority of family living areas in Tianjin. Please check with the Admissions office for eligibility.

Q6: What is the relationship between Wellington College Bilingual Tianjin Nursery and Wellington College in England?

Wellington College Bilingual Tianjin Nursery and Wellington College in England hold a uniquely close relationship at all levels from governance to pupil and faculty exchanges. This relationship allows for an exchange of ideas and professional learning and ensures that we uphold our Values, Identity and the highest quality of education.

Q7: Does Wellington provide a Mandarin Programme?

Though the language of the tinajin bilingual kindergarten and the curriculum is in English, we recognise the importance of Mandarin to our pupils and their families. In all years, pupils are taught by Mandarin specialist class teachers on a daily basis who can adapt to those taking their first steps in learning Chinese as well as those who may be bilingual or have parents for whom Mandarin is their first language. School also works outside the formal classroom learning, offering a wide variety of Chinese cultural activities as well as organising celebrations of traditional Chinese festivals.

Q8: How much time is devoted to sports weekly?

Sport is an integral part of each pupil’s development, wellbeing and education. As such, our pupils engage in separate Physical Education and Swimming classes weekly. Through our ASA programme, as well as Sports Days and other school sport competitions, our pupils enjoy access to our gymnasium, football pitch, 100-metres all-weather synthetic running track, basketball and Tennis courts, and two swimming pools, including one especially for younger children, and one 25-metre, six-lane competition pool.

Q9: How is Wellington’s bilingual education implanted in Early Years?

We define people who can fluently speak and use two languages as

“bilingual”. They must be able to switch freely between the two

languages. We call language the carrier of culture, which means learning

a language is also learning a culture. Therefore, our children are

learning two different cultures, consciously or unconsciously, in the

progress of acquisition of these two different languages. The exposure

of bilingual education greatly helps children in language acquisition

including cognitive and emotional development as they grow. Compared to

children with a single language background, researchers have found more

active areas in the cerebral cortex of bilingual children. While those

who receive bilingual education prove to be more able in thinking

outside of the box and empathise with others.

Here at Wellington, we aim to allow children to “walk” freely between

these two forms of language and culture. We help them to develop a

bilingual person’s mindset to think in various ways and feel comfortable

in different cultural environments.

By creating a bilingual environment we develop children’s ‘native sense’

in two languages, and we try our best to let them learn to express

themselves in a native speakers’ way.

Q10: What type of community events do you have?

A strong sense of community forms the foundation for all that we do at Wellington. In addition to school events throughout the year from concerts to sports and our much-coveted annual Musical, Wellington is proud to be an active member of the greater community. Wellington College Tianjin is also a proud host of the Festival of Education, or EdFest, hosted annually at each of the Wellington College China campuses. EdFest provides an opportunity for debates about education and the place it has in a rapidly changing world. Education’s disciplines and expectations can no longer be taken for granted and are being revisited, revised and renewed. The significance that Chinese culture places on learning means that the city is likely to become pivotal in the reshaping of world education in the 21st century.

Q11: How to help children prepare forNursery before they go to school?

Stepping into the Nursery is the children’s “first step” into the

real world. This is a milestone in their lives and parents can play a

crucial part in a child’s transition from home to school.

Parents are the key to easing separation anxiety. Parents need to feel

secure that children will transition into their new environment by

sending positive messages and allay any fears they may have about

starting school. A few examples that parents can do to prepare their

children include: reading books about settling into a new school;

arrange for a school tour in advance; meet with the teachers; and do a

role-play of the Nursery at home.

Parents can learn about the daily schedule at school with their children and help them prepare their bags, blankets for taking a nap, uniforms, water bottles and so on. Parents can also help their children label their belongings with name tags to develop a sense of ownership and responsibility. Furthermore, parents can bring a blanket or a toy that the children are attached to, to give comfort to them at school.

Most children who are about to go to the tinajin bilingual kindergarten, are ready to leave home and see what the world looks like. This is marked as a “right of passage” for children to become a member of society and requires them to be as independent as they can be. The parents are encouraged to create more opportunities for children to practice their social skills, such as how to express their needs and how to communicate with their friends.

Q12: What are the children in Wellington College Bilingual Tianjin Nursery doing right now??

Maintaining a positive relationship between teachers and children. Our goal is to develop a positive relationship so that teachers and children trust each other. This helps children’s development in their social and emotional skills. A positive relationship builds a solid foundation which helps children develop good manners, independence, confidence and reading skills.

Learning doesn’t only happen in the classrooms. Teachers hope to enrich children’s learning at home in various ways by explaining new ways to connect children and their parents. We encourage parents to use this opportunity of home learning to explore and try different activities with their children. Cooking, planting, housework and others help children improve their internal motivation as these activities become enjoyable to them.

Our Admissions Team is always available to provide advice and assistance. If you have any questions, please feel free to contact us through the official website of Wellington College Bilingual Tianjin Nursery.

Wellington College Bilingual Tianjin Nursery

Tinajin bilingual kindergarten-Wellington College Bilingual Tianjin

Nursery officially opened its doors to pupils in September 2017,

offering our specialised bilingual programme that delivers the very best

of Western and Eastern education with the integration of both the UK

Early Years’ Foundation Stage (EYFS) and the Chinese expectations for

Early Years’ children. As with all Wellington College schools, the

Wellington Values and Identities form the core of the holistic education

provided by Wellington College Bilingual Tianjin Nursery.

World of Warcraft Shadowlands: How will the leveling system work?

Since the release of WoW Classic on August 27, more and more players have chosen to return to the Azeroth continent 15 years ago in pursuit of nostalgia. But it cannot be denied that for other players, modern WoW is more attractive because players can experience richer endgame contents. In addition, the current upper limit of the level in the game has also affected the players to a certain extent. Those working adults often complain that they need to spend more free time to improve the character level. Fortunately, Blizzard now provides a solution to this problem.To get more news about WoW Items, you can visit lootwowgold news official website.

In the most primitive World of Warcraft, players have a level cap of 60. However, Blizzard will open a new level cap in each subsequent expansion. Players need to upgrade to the max level to unlock and experience the new content in the expansion. Until the latest expansion of the Battle for Azeroth, the player's level cap has reached a terrible 120. Although Blizzard bundled and gave away tokens to improve the level in the expansion, this did not fundamentally solve the problem. Players still took a long time to level up after created new characters.

Blizzard's development team challenged the level dilemma and announced their solution through BlizzCon 2019, in the eighth extension, Shadowlands. The expanded plot follows the BFA, and the player's character will travel to the afterlife. At the same time, the player's level cap will not be increased to 130, but will be reduced to 60.

In the Shadowlands expansion, players at level 120 will be adjusted to level 50, and they need to reach the max level by new content in Shadowlands. Those beginners who have not played World of Warcraft before will be familiar with the entire universe from level 1. They will go through an immersive system tutorial to master the most basic World of Warcraft knowledge. This process will help them successfully reach level 10. After that, they will be sent to the battlefield and participate in BFA until they reach level 50, then they will also enter Shadowlands and pass the final leveling stage.

For experienced players who've already experienced the process, or just those who are trying to reach high levels to play the new content, it should make for a smoother and more enjoyable experience with less grinding plus more options on what to play. At level 60, players can join a Covenant, which ties into the expansion's afterlife theme and grants characters with new powers from the group they join.

In addition to a more relaxed leveling system, Blizzard also offers players another surprise: new character customization options. It allows you to create an avatar that belongs to you in the game. In addition to skin color, you can also adjust the character's tattoo and hairstyle.

use vulpera or mechagnomes race in World of Warcraft

World of Warcraft's Battle for Azeroth expansion is about to usher in the next major update, January 2020. This update is called Visions of N'Zoth. Compared with the update, it is more like an extension, because the development team has added a lot of new content to the game in this update.To get more news about Buy WoW Gold Classic, you can visit lootwowgold news official website.

The origin of this series of events is that the prison of Seal N'Zoth was destroyed, and he escaped smoothly. There is nothing worse than that. He gradually recovered his strength and began to bring endless fear to the world. As an ancient god, every move he made will have an unpredictable impact on the Azeroth continent. This will also drive the Horde and Alliance heroes to cooperate again. They need to defeat N'Zoth and end all sources of fear before Stormwind and Orgrimmar are completely eroded.

To accomplish this, both the Horde and the Alliance have acquired new Alliance races, and you can play as a fox or semi-mechanized gnome in the next update. Vulpera is an ally of the Horde heroes. They live in the desert all year round and look like cute foxes. Mechagnomes became friends of the Alliance. They are semi-mechanized troops, you can only see from their faces that they used to be real gnomes.

It's worth noting that you can't directly create characters with the new Alliance races immediately after the update, because you need to complete all prerequisites first. The mission is not very complicated, you only need to reach the sublime in the corresponding ethnic faction and complete all the mission lines to unlock specific achievements. Then you can use them.

The Horrific Visions will provide new challenges for players who are keen on the mage tower. Here, players need to fight against the will of N'Zoth, and you will see the future in it. If the heroes of the Azeroth continent are N'Zoth, the whole world will be corrupted. It is important to stay sane, otherwise you will need to retreat, but you will also have all the knowledge you have learned along the way. Fortunately you will get the help of the black prince Ragio, and you will work with him to create a legendary cloak, which will provide you with a certain amount of protection, so that you can persist longer under the mental attack of N'Zoth, And you can further improve the quality of the cloak by constantly exploring the Horrific Visions.

Visions of N'Zoth goes live on January 14 in the US and January 15 in Europe, but you'll need to wait a bit longer for the raid. The Sleeping City will wake up properly on January 22, on Normal and Heroic, with Mythic becoming available a week later, when you'll also be able to start using the raid finder.

What happens when lottery money isn't claimed in Arizona?

The

winner of a $14.6 million lottery prize never showed up.The deadline to

claim the prize was 5 p.m. Monday evening.Get more news about 菲律宾彩票包网服务 ,you can vist loto98.com

Lottery officials have been waiting for nearly six months for someone

to claim the money after the winning ticket was bought in the West

Valley.

When Doug Mohan heard there was a $14.6 million lottery ticket still unclaimed he figured why not check to see if he’d won.

"I have a few tickets I haven’t checked. So I heard about this 14

million and thought 'I better come down here and see how much money I

blew and wasted'," Mohan said.

Mohan didn’t win the big prize and

whoever did win didn’t claim it within the 180-day time frame. The

ticket was bought at a Circle K on Litchfield Road and Van Buren Street

in Goodyear on June 5.

"It's 14.6 million dollars and that comes out

to a cash option prize of just over nine million," Arizona Lottery

spokesperson John Gilliland said.

Gilliland says that’s what the winner would’ve gotten if they claimed the prize. The Circle K would have gotten $10,000.

But now that we know it wasn’t claimed--- what’s next?

"All unclaimed prize money is determined by state statute where that

money goes," Gilliland said. As for Doug Mohan he says he’s always

looking on the bright side. Even though he didn’t win big this time he

still won something.

"Look, I won two dollars on a four dollar ticket, but I’m still two in the hole," Mohan said.

In the past fiscal year, from July 2018 to June 2019, $11.6 million in winnings have gone unclaimed.

Check your Powerball tickets

The video above is about the Mega

Millions jackpot winner in Glendale last month.Someone in the Valley may

be able to claim a large chunk of change.Get more news about 菲律宾彩票包网平台,you can vist loto98.com

A $50,000 winning Powerball ticket was sold at a Superpumper on 90th

Street and Frank Lloyd Wright Boulevard in Scottsdale has not been

claimed yet.The lucky person matched four of five numbers, plus the red

Powerball number. The winning numbers were 3-10-34-36-62 with a red

Powerball number of 05.The winner of a $14.6 million lottery prize never

showed up.

The deadline to claim the prize was 5 p.m. Monday evening.

Lottery officials have been waiting for nearly six months for someone

to claim the money after the winning ticket was bought in the West

Valley.

When Doug Mohan heard there was a $14.6 million lottery ticket still unclaimed he figured why not check to see if he’d won.

"I have a few tickets I haven’t checked. So I heard about this 14

million and thought 'I better come down here and see how much money I

blew and wasted'," Mohan said.

Mohan didn’t win the big prize and

whoever did win didn’t claim it within the 180-day time frame. The

ticket was bought at a Circle K on Litchfield Road and Van Buren Street

in Goodyear on June 5.

"It's 14.6 million dollars and that comes out

to a cash option prize of just over nine million," Arizona Lottery

spokesperson John Gilliland said.

Gilliland says that’s what the

winner would’ve gotten if they claimed the prize. The Circle K would

have gotten $10,000. As for Doug Mohan he says he’s always looking on

the bright side. Even though he didn’t win big this time he still won

something.

"Look, I won two dollars on a four dollar ticket, but I’m still two in the hole," Mohan said.

In the past fiscal year, from July 2018 to June 2019, $11.6 million in winnings have gone unclaimed.