freemexy's blog

An 82-year-old man from Combermere, Ont. is one million dollars richer after his Lotto Max ticket won a Maxmillions prize, the Ontario Lottery and Gaming Corporation (OLG) said Monday, in a win that came about because of a mistake at the cash register.Get more news about 菲律宾彩票包网平台,you can vist loto98.com

Michael Butt said he had gone in to buy a Lotto 6/49 ticket but the cashier mistakenly printed a Lotto Max ticket for him. It was that ticket that won the April 7 draw.

“This wouldn’t have happened without [the cashier”>,” Butt is quoted saying in an OLG press release. “I was there to buy a ticket for the Lotto 6/49 draw and she selected the wrong draw and printed a Lotto Max ticket.”

Butt said he tipped the cashier who sold him the ticket when he went to validate it after learning he had won.

OLG says Butt’s brother previously won $3.5 million playing the lottery in the late 1980s.

OLG prize claims for tickets over $50,000 can now be collected in-person in Toronto by appointment only. The corporation is reaching out the prize winners to schedule appointments.

The family of Dr Stanley Ho expressed their grief at the passing of their father, Dr Stanley Ho, at a press conference in Hong Kong on Tuesday.To get more news about stanley ho family, you can visit shine news official website.

Dr Ho, the father of modern Macau, passed away at the age of 98 at Hong Kong Sanatorium and Hospital following a long battle with illness, with his daughter, Pansy Ho Chiu King, addressing the media shortly afterwards.Father passed away around 1pm in his sleep peacefully today at the age of 98,” said Ho, the Co-Chairperson and Executive Director of MGM China Holdings Ltd, Group Executive Chairman and Managing Director of Shun Tak Holdings, and Director of STDM.

“Although we knew this day would come, it did not release any of our unspeakable sadness. Dr Ho, my father, will always stay in our hearts.”

Dr Ho’s fourth wife and SJM Holdings Co-Chairman and Executive Director, Angela Leong On Kei, and his son, Melco Resorts & Entertainment Chairman and CEO Lawrence Ho, also stood with the family. Details of Dr Ho’s funeral are set to be announced in the coming days.STDM, Shun Tak Holdings Ltd, Sociedade de Jogos de Macau S.A. (SJM) and SJM Holdings Ltd released a joint obituary to commemorate the loss, while Hotel Lisboa and Grand Lisboa lowered their flags to half-mast.

“Over the past 50 years, Dr Ho had steered the revolutionary development of Macau’s gaming and entertainment industry, with the objective of diversifying its growth to drive parallel advancements in social, infrastructural and cultural developments and injected Macau with the necessary vitality to transform into a world class international tourism destination as it is known today,” the obituary stated.Vice Chairman of the Chinese People’s Political Consultative Conference (CPPCC) and the former Macau SAR Chief Executive, Edmund Ho Hau Wah, and current Chief Executive Ho Iat Seng sent condolence letters to the Ho family, commending Dr Ho’s lifelong commitment to charity and his significant contribution to the economic prosperity and stability of Macau. Dr Ho had been a member of the 9th to 11th CPPCC Standing Committees.

The Liaison Office of the Central People’s Government in Macau also issued a statement to Dr Ho’s relatives, expressing its deep condolences for his passing. The statement noted that Dr Ho had been loyal to the country, actively promoting the implementation of the “One country, Two systems” principle and making important contributions to Macau’s handover in 1999.

Hong Kong SAR Chief Executive Carrie Lam also expressed her deep sorrow over the passing of Dr Ho.

Stanley Ho, the billionaire dubbed the “King of Gambling,” officially

retired last April. Since then, several of his children and one of his

wives have been feuding for control of his casino empire in Macau.Ho,

97-years-old, has been married to four different women who have birthed

17 of his children. Fifteen are still alive, and some of them are

jockeying for power of SJM Holdings, the casino group Ho founded in

1962.To get more news about stanley ho children, you can visit shine news official website.

Pansy has made a fortune in her own right – along with operating a Hong

Kong shipping and ferry business, she was responsible for forming MGM

China with the late billionaire Kirk Kerkorian.

The Straits Times says Pansy’s goal is to ensure stability in the wake of her father’s departure. She also wants to prevent Angela Leong, Ho’s fourth wife, from taking control. SJM is valued at $6 billion.SJM Holdings lost its monopoly on commercial gambling in Macau soon after Portugal returned the enclave to the People’s Republic in 1999.

The only place in China where casinos are permitted, Macau today has six licensed operators. Along with SJM, Las Vegas Sands, MGM, Wynn, Melco, and Galaxy Entertainment operate gaming floors.

SJM and MGM Resorts will see their licenses expire in 2020. The four others are scheduled to terminate two years later.Melco Resorts was founded by Ho’s ninth child Lawrence. The 42-year-old originally founded the organization as Melco Crown Entertainment with fellow billionaire James Packer.

Lawrence severed his relationship with the Australian casino giant after Chinese authorities arrested numerous Crown Resorts employees on “gambling crimes.” Ho would later state that Crown was “deliberately spitting” on Chinese law.Ho’s career began in the importing and exporting business. He allegedly smuggled food and luxury goods into China from Macau to initially create his fortune. In 1962, he convinced the Macau government to grant him a license to operate casinos. He was Macau’s only permitted gambling operator for the next 40 years.

SJM has continued to see its market share shrink over the last 15 years. As multibillion-dollar integrated resorts spread across Macau and the Cotai Strip, Ho failed to follow suit. Only now is the company building in Cotai – more than a decade after Sands opened The Venetian.

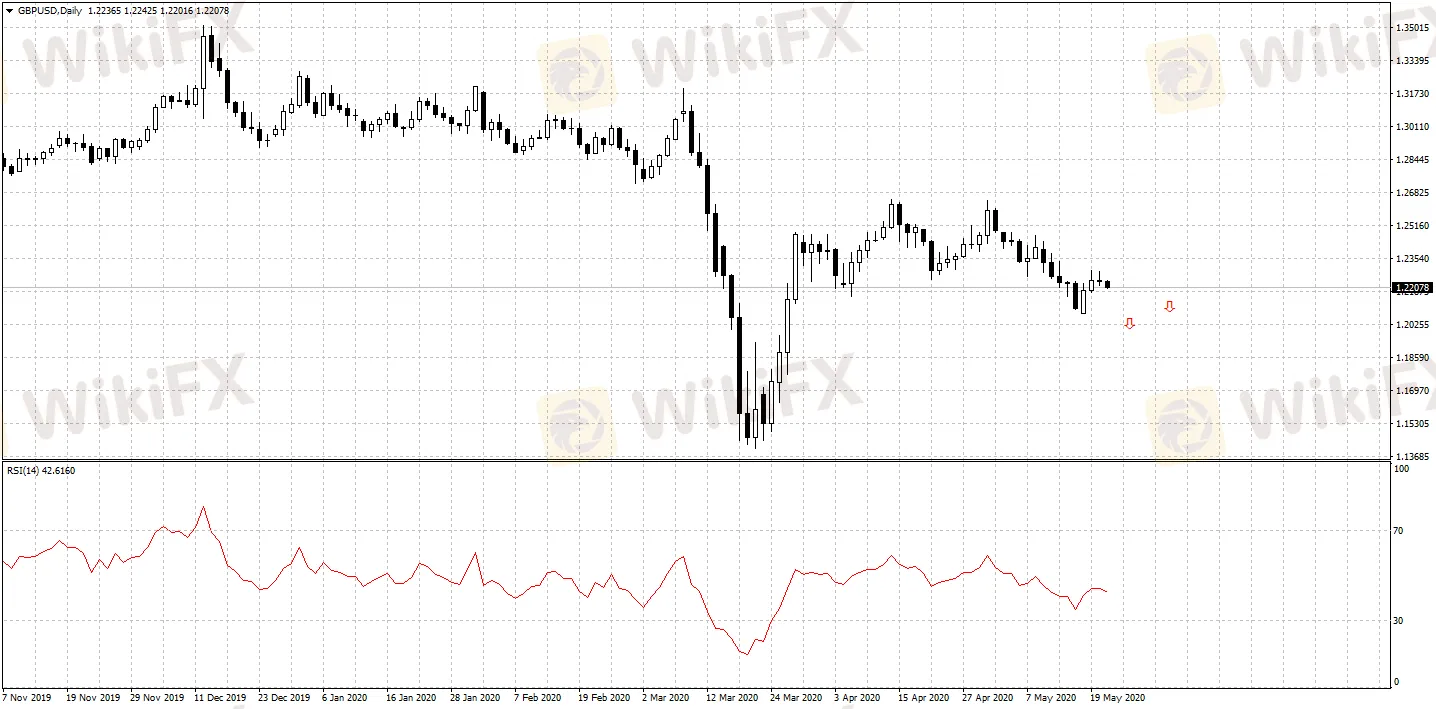

In addition, Britan‘s CPI grew 0.8% year-on-year, lower than economists’ expectations. The figure may kindle an even more heated debate over whether the central bank should introduce negative interest rate for the first time.

HSBC downgraded its forecast of GBP/USD before the end of the year from the previous 1.35 to 1.2, while pointing out the risks including Britains fiscal well-being(as the worst of G10 members) and Brexit: euro is expected to rise from 0.81 to 0.87 against pound before the end of the year, the British government again dismissed the possibility of extending the Brexit transitional period, while it seems unlikely for the two sides to completely settle a free trade deal before the end of 2020.

With Britain sinking into a severe recession and the economy in sluggish recovery, structural factors may further weigh on the pound.

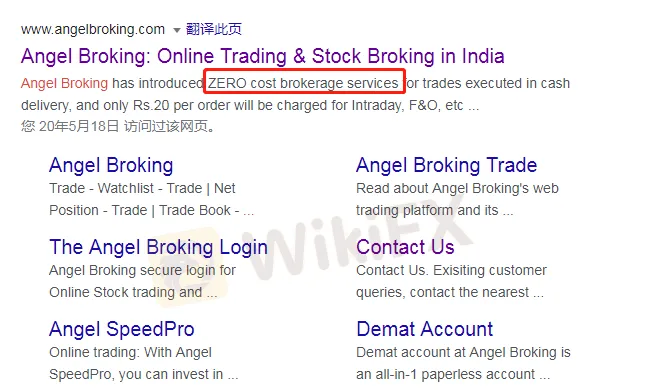

Recently, an Indian investor complained against the broker Angel Broking for unjustified deduction from his trading account, hoping to bring the broker to justice. The complainant told WikiFX that he was attracted to Angel Broking for its so-called zero cost brokerage.

Angel Brokings advertisement on moneycontrol, an established Indian financial media

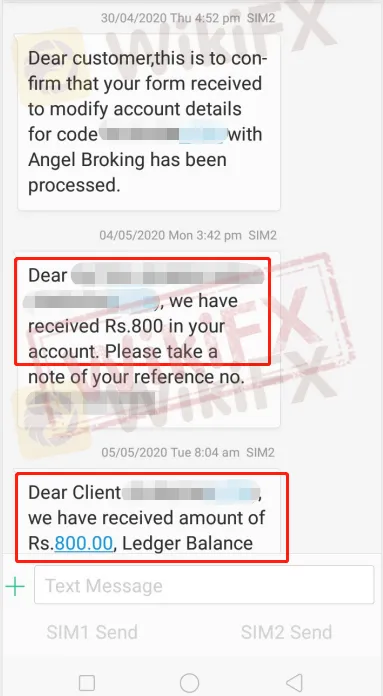

But not long after he made his deposits, investor received several confirmation text messages of account deduction generated by the broker, each time for 800 rupees.

Through observation, the investor found that every transaction from his trading account will generate an automatic deduction of account balance which goes to the broker. He complained that Angel Broking‘s advertisements about “zero commission” is an outright lie as they make unreasonable deduction of investor’s account and exploit investors trust.

We may conclude that Angel Broking is an illegal broker which tries to lure investors to its trap with the bait of so-called “zero commission”. Per checking WikiFX App, Angel Broking is rated at only 1.20 and is currently unregulated, so please stay away!

In India‘s forex market, there are still many brokers like Angel Broking that try to scam investors by claiming to charge attractively low commissions. Major discount brokers in India like upstox and Zerodha are also being heavily complained recently for withdrawal failure, trading server lag and causing unjustified losses. Indian investors should definitely be more aware, as many investors choose a broker solely base on its commission, yet seldom pay attention to the broker’s compliance. Even some brokers on the regulatory list of SEBI are not necessarily reliable and worth-choosing. Stay tuned as WikiFX continues to present you latest exposures of Indian forex brokers.

So far, WikiFX App has included profiles of over 18,000 forex brokers around the world, while integrating broker information query, exposure, news feed and other functions, offering investors 24/7 services.

The world's third biggest economy shrank 3.4% in the first three months of 2020 compared to a year ago, its biggest slump since 2015.

The coronavirus is wreaking havoc on the global economy with an estimated cost of up to $8.8tn (£7.1tn).

Last week, Germany slipped into recession as more major economies face the impact of sustained lockdowns.

Japan didn't go into full national lockdown but issued a state of emergency in April severely affecting supply chains and businesses in the trade-reliant nation.

The 3.4% fall in growth domestic product (GDP) for the first three months of 2020, follows a 6.4% decline during the last quarter of 2019, pushing Japan into a technical recession.

More financial stimulus to come

Consumers have been hit by the dual impact of the coronavirus and a sales tax hike to 10% from 8% in October.

While Japan has lifted the state of emergency in 39 out of its 47 prefectures, the economic outlook for this current quarter is equally gloomy.

Analysts polled by Reuters expect the country's economy to shrink 22% during April to June, which would be its biggest decline on record.

The Japanese government has already announced a record $1 trillion stimulus package, and the Bank of Japan expanded its stimulus measures for the second straight month in April.

Prime minister Shinzo Abe has pledged a second budget later this month to fund fresh spending measures to cushion the economic blow of the pandemic.

How can Japan turn things around?

Japan faces a unique challenge as its economy has been stagnant for decades, compared to the more buoyant economies of rivals the US and China.

Japan also relies heavily on exporting its goods and has little control over consumer demand in other countries which have been severely impacted by coronavirus lockdowns. Many of its biggest brands, like car firms Toyota and Honda, have seen sales slump across the world.

Tourism, which has long been a boost to the Japanese economy, has also been hit hard as the pandemic keeps foreign visitors away. Japan has had more than 16,000 confirmed coronavirus cases and around 740 deaths.

How does it compare to other major economies?

Things look bleak for the Japanese economy in the short term, along with other major economies around the world. But despite being the first of the world's top three economies to officially fall into recession, the country actually appears to be doing better, or less badly, than other major economies.

While economists predict Japan's economy will shrink by 22% this current quarter, they also predict that the US could contract by more than 25%. The 3.4% decline also compares favourably to the 4.8% the US suffered in the first three months of this year.

This was the sharpest decline for the US economy, the world's biggest, since the Great Depression of the 1930s.

China, the world's second largest economy, saw economic growth shrink 6.8% in the first three months of the year, its first quarterly contraction since records began.

Both of those economies haven't yet been confirmed as having fallen into a technical recession, which is defined as two consecutive quarters of negative growth, but most economists expect them to in the coming months.

Yesterday, A *** R, an investor from India, told us about his experience. A *** R started trading currency pairs on the OctaFX platform at the beginning of 2020, and at first it was either a loss or a small profit. In March, A *** R made a considerable profit by trading XAU/USD. But the good luck didn't last for long, as the platform suddenly stopped XAU/USD trading on March 25th.

On April 9th, XAU/USD trading was resumed. During this period, A *** R submitted a withdrawal application because there was no profit, but unexpectedly, his application was immediately rejected by the system, and his following withdrawal requests remained "under review".

When waiting for the matter to resolve, A *** R eventually lost his US$75,000 account balance. "Whether you make a profit or loss, money always belongs to the broker and you will never get it," A *** R concluded, saying that blinded by the desire to make an instant fortune, he did not check OctaFX's qualifications in before investing.

According to WikiFX App risk reminder, OctaFX has been intensively complained in the past month, and has been listed as an illegal broker by WikiFX, with a score of only 1.90 points. The broker has a very short history, holding CySEC MM license for less than 2 years. Investors should watch out for it.

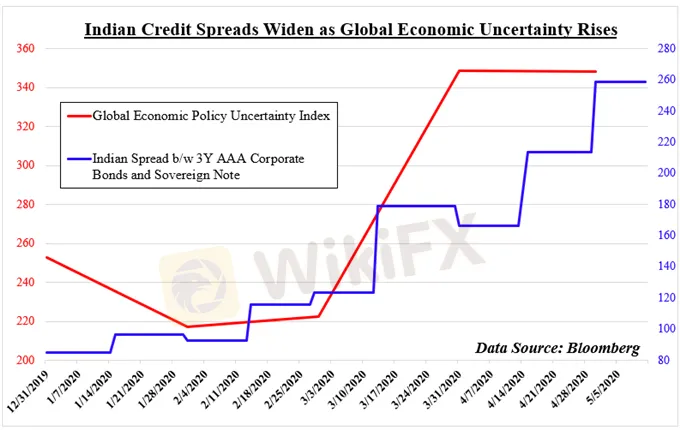

Markit India Manufacturing PMI and Services PMI both hit a record low in April, at 27.4 and 5.4 respectively. A reading below 50 usually indicates shrinking business activities.

According to a survey by the Indian Economic Supervision Center (CMIE), the unemployment rate in India will reach a record high of 27.1%. In order to help the Indian economy severely affected by the epidemic, the Indian authorities have taken action in fiscal and monetary policies. To date, stimulus measures of about 1.7 trillion Indian rupees have been implemented, accounting for about 0.8% of GDP.

India's credit spread has widened year to date, hovering around 260 basis points. This credit spread is basically the difference in yield between Indian AAA corporate bonds and the sovereign government bonds of the same level.

With rising global economic uncertainties and the possibility for India to lift social distancing measures, the Indian rupee may face difficulties in the coming weeks.

British Pound Experiencing Political Fatigue

The British Pound may suffer as the UK faces internal political fragmentation following Prime Minister Boris Johnson‘s announcement of easing lockdown measures. Last month, in a broadcast reaching over 27 million Britons, Mr. Johnson changed the policy approach from “stay at home” to “stay alert”. This was implemented as a way to balance the public’s health with maintaining the countrys economic integrity.

However, this been met with growing opposition from lawmakers, who are openly dissenting orders like those put forth by the government to reopen schools on June 1. Adam Price, leader of the Plaid Cymru Welsh outwardly expressed his defiance of Mr. Johnsons announcement:

“Lets not beat about the bush…If you drove into Wales from England at the moment without a legitimate excuse you would get arrested. Many people would not have thought that it was even possible but it is the reality on the ground.”

In Europe, the United Kingdom has the highest number of deaths at around 34, 546 and a case-fatality rate of 14.3 percent. Furthermore, renewed fear about the prospect of a disorderly Brexit has been weighing on the British Pound since last Friday, adding a spice of political uncertainty to the situation. For a more in-depth analysis, see my geopolitical outlook for the week ahead here.

Euro Analysis vs British Pound: Outlook Bearish

EUR/GBP may aim to challenge a key inflection range between 0.8986 and 0.9019 (purple-dotted lines). The pairs recent ascent has been in large part to do with fundamental forces pressuring GBP. If the pair clears this range with follow-through, the next ceiling to deconstruct may be between 0.9144 and 0.9178 where EUR/GBP previously stalled following its aggressive decline from the multi-month swing-high at 0.9417.

Recommended by Daniel Dubrovsky

What is the road ahead for the Japanese Yen?

Get My Guide

While market mood was generally upbeat throughout the session, the pace aggressively picked up tempo in late European and early North American trade. Reports crossed the wires from Moderna – a US biotechnology company – that a vaccine had ‘promising results’ in an early interim clinical trial. The doses triggered an immune response in eight healthy volunteers. The CEO of Moderna said the data ‘couldn’t have been better.

The results likely brought forward expectations of a sooner-than-anticipated recovery in global growth. WTI crude oil closed at its highest in over 2 months. This is as China reported that oil demand at pre-covid 19 levels. Energy shares were the outperformers on Wall Street followed by industrial stocks. The Euro appreciated as Germany and France proposed a €500 billion coronavirus recovery fund.

Discover your trading personality to help find forms of analyzing financial markets

Tuesdays Asia Pacific Trading Session

With that in mind, Asia Pacific equities may follow Wall Street higher. That could open the door for the Australian and New Zealand Dollars to expand upon gains over the past 24 hours. The AUD/USD may also look past incoming RBA meeting minutes after a rather tepid response to the rate announcement earlier this month. It may focus on broader sentiment instead. An upbeat tone may also bode ill for the Yen.

Japanese Yen Technical Analysis

USD/JPY may still be in a position to see gains pickup from a technical standpoint. Last week, prices pushed above a bullish Falling Wedge chart pattern. Follow-through has been somewhat lackluster, but prices seem to be pointing upward after testing near-term rising support from May 6 – red line below. That places the focus on immediate resistance at 107.77. Clearing the latter may pave the way for further gains.